Swish: Sweden’s Mobile Payment System and Its Potential for International Digital Services

Swish has become a central part of Sweden’s cashless economy, offering fast and secure mobile payments for both private users and companies. Since its launch by major Swedish banks and Bankgirot, the system has turned into a nationwide method for instant transactions linked directly to bank accounts. As digital commerce expands globally, interest in Swish’s technical model, compliance standards and scalability continues to grow. This overview explains how Swish works today and evaluates its potential role in international digital services in 2025.

How Swish Operates Within Sweden’s Financial Ecosystem

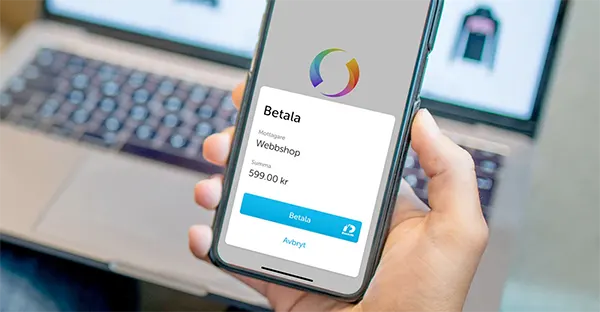

Swish relies on direct integration with participating banks, using a real-time infrastructure that processes payments within seconds. Each user connects their mobile number with a bank account, enabling transfers that are verified through BankID, Sweden’s national digital identification system. This method ensures account-to-account payments without relying on cards or external intermediaries.

Commercial use has grown rapidly: companies, charities and public services accept Swish for everything from retail transactions to service fees. Its speed and authentication security have made it a standard option across the country. Because verification uses BankID, the system maintains strict alignment with Swedish regulatory requirements, providing strong protection against unauthorised access.

As of 2025, more than eight million residents are active users, reflecting its near-universal reach. The system processes billions of kronor in monthly transactions and continues to expand features for business clients, including QR-code payments and digital invoicing. These capabilities position Swish as a robust example of national-level real-time payments.

Security Standards Supporting User Trust

Security is one of Swish’s defining strengths. Its dependence on BankID means every payment is tied to verified digital identity. This reduces fraud potential and ensures that financial institutions can link each transaction to a verified individual or organisation. Multi-layer authentication contributes to a secure environment suitable for both consumer and enterprise use.

Data transfer and transaction processing follow strict Swedish and EU guidelines, particularly PSD2 and GDPR. The combination of encrypted communication, regulated infrastructure and identity verification contributes to a high level of accountability. These measures are essential for maintaining operational stability as transaction volume increases.

The system’s reliability is reinforced further by continuous cooperation between Sweden’s leading banks. Shared governance ensures uniform standards and reduces fragmentation, which is a common challenge in other national payment systems. As Swish evolves, its emphasis on regulated identity-backed payments remains a core component of its value.

Potential for Cross-Border Use and International Expansion

Although Swish is currently available only to accounts within Swedish banks, its technical model attracts significant attention from companies developing global fintech services. Real-time account-to-account transfers, identity-based authentication and strong regulatory compliance offer a framework that could inspire cross-border solutions. Several European markets are exploring similar systems, especially as the EU works on harmonising instant payments.

One barrier to expansion is the reliance on BankID, which is tied specifically to Swedish residents. However, international providers can use Swish as a case study for integrating national identity systems with financial services. The success of Swish demonstrates how digital identity can reduce friction and strengthen payment integrity.

Swish’s principles align with wider European financial goals, such as interoperability between real-time payment schemes. With the EU Instant Payments Regulation coming into effect, Swish’s model may influence how European service providers design authentication and settlement structures. This increases the relevance of Swish as a reference point for developing safe and scalable systems across borders.

Challenges to International Adoption

The largest challenge in reaching non-Swedish users is the lack of a unified digital identity system comparable to BankID in other countries. Without a secure and universal authentication method, financial institutions face higher risks and regulatory obstacles. This limits Swish’s ability to function internationally in its current form.

Additionally, instant payments require coordinated banking infrastructure. Many countries still depend on slower settlement networks or lack a common standard for immediate transfers. Adapting Swish to operate within diverse financial ecosystems would require significant technical and regulatory alignment.

There is also a commercial consideration. Sweden’s market scale allows a single system to operate efficiently, whereas larger regions may require broader partnerships. Any international expansion would need agreements between banks, regulators and identity providers to replicate Sweden’s integrated model.

Swish as a Blueprint for Global Digital Services

Even without direct cross-border availability, Swish serves as an important benchmark for digital payment services worldwide. Its success proves that national real-time systems can achieve widespread adoption when supported by strong identity frameworks and unified bank cooperation. This makes Swish a model for governments considering updates to their own financial infrastructure.

For international digital services, Swish’s approach offers valuable insights into user behaviour. Consumers prefer instant transactions that are easy to verify and secure, especially in subscription-based or on-demand services. Businesses can observe how Swish’s payment flows reduce friction and encourage repeated use.

As global financial services continue to emphasise security and transparency, Swish’s structure highlights the importance of identity-linked transactions. Service providers looking to strengthen regulatory compliance, especially in regions with strict financial monitoring, can use Swish’s model as a foundation for developing trusted payment processes.

Future Outlook and Long-Term Influence

By 2025, Swish’s influence extends far beyond Sweden. Fintech developers and policymakers often reference its architecture when designing instant payment systems. The combination of national identity verification and bank-level cooperation demonstrates how digital payments can operate securely at scale.

The growing demand for reliable cross-border payments suggests that identity-based authentication may become more common globally. If other countries establish digital identity frameworks similar to BankID, Swish’s model could become a foundation for future international networks. This would support smoother interactions between digital services and financial institutions.

Swish continues to evolve, and its long-term impact will likely come from shaping standards for safety, user authentication and instant settlement. While rooted in Sweden, its methodology provides valuable direction for modernising global payment infrastructure.