N26 Payment Solution: A Deep Dive into Modern Banking

Amidst a revolution in digital banking, N26 stands out as a cutting-edge fintech solution. Designed to cater to the modern user’s needs, it reshapes the way we view traditional banking. By offering flexibility, security, and efficiency, N26 has earned its place among the top payment solutions.

Story

Launched in 2013 in Berlin, N26’s vision was clear: to reinvent the banking experience for the digital age. Over the years, it has transformed from a startup into a full-fledged bank, serving millions across the globe. It’s not just a bank, but a digital banking solution, emphasizing simplicity and user experience.

Advantages and Disadvantages

Advantages:

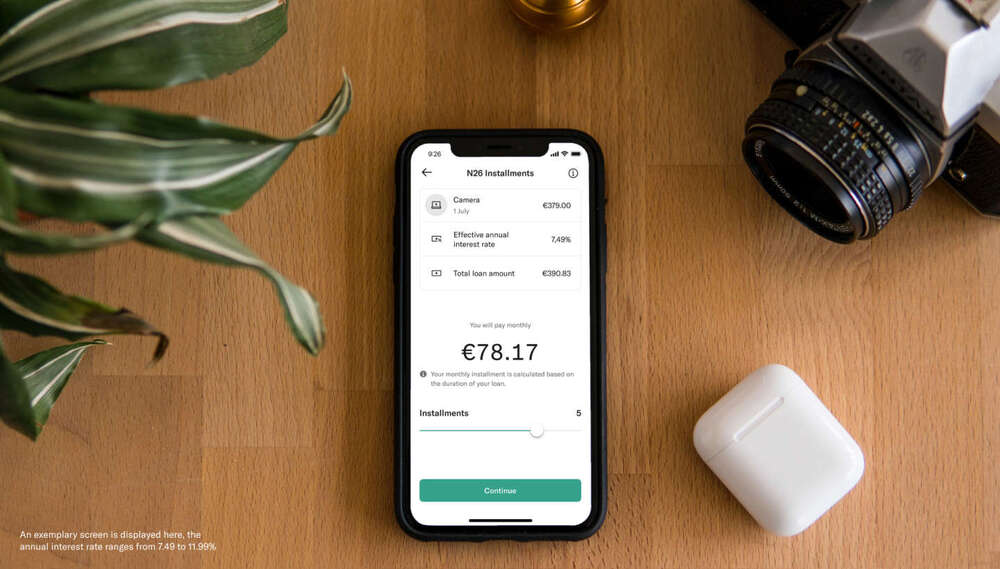

- User-friendly Interface: N26’s mobile app is intuitive, making banking operations a breeze.

- Global Usage: With real-time transaction notifications and no foreign transaction fees, it’s perfect for travelers.

- Transparent Fee Structure: Say goodbye to hidden charges and fees.

Disadvantages:

- Limited Physical Presence: Being primarily an online bank, there’s a lack of brick-and-mortar branches.

- Dependence on Internet: Essential banking operations need a stable internet connection.

How to use N26 in Online Casinos

Enjoying your BetNero casino games and looking to deposit or withdraw funds? N26 makes it seamless:

- Login: Access your favorite online casino and head to the payment section.

- Select N26: Among the listed payment options, choose N26.

- Specify the Amount: Enter your desired deposit or withdrawal amount.

- Authorize Payment: Follow the prompts, which usually involve logging into your N26 account to confirm the transaction.

- Start Playing: With instant transfers, dive into your gaming session without delay.

Regions

N26 started in Europe, but its vision was global. It has since expanded its presence, currently available in many European countries, the US, and is in the process of rolling out to other regions.

Payment Methods

N26 offers a range of payment solutions:

- Direct Bank Transfer: Transfer money directly from your N26 account.

- Debit and Credit Cards: Linked Mastercard for both online and offline transactions.

- Mobile Payment: Apple Pay and Google Pay compatibility for quick transactions.

Customer Support

Priding itself on its stellar customer service, N26 offers:

- In-app Chat: Instant support right within the application.

- Email: For less urgent queries, reaching out via their email system ensures detailed responses.

- Help Center: An extensive FAQ section to address common concerns.

Safety

Safety is at the heart of N26. With fingerprint and face recognition, two-factor authentication, and real-time transaction alerts, it provides a secure banking environment.

Licenses

N26 operates under a European banking license, ensuring adherence to strict financial regulations and standards.

Conclusion

N26 isn’t just another digital bank. It’s a revolution, challenging the norms and setting new standards. As digital banking continues to evolve, N26 promises to be at the forefront, leading the way.