Stripe Payment System Review

Stripe has emerged as a cornerstone in the digital payment landscape, offering seamless transaction solutions for businesses worldwide. This review delves into the creation, official recognition, application spectrum, and unique advantages of Stripe, providing insights into its adoption for online casinos and its enduring legacy in the fintech sector.

The Genesis of Stripe

Founded in 2010 by Patrick and John Collison, Stripe was born out of the necessity for a more developer-friendly payment system. It quickly distinguished itself with its straightforward APIs and emphasis on technology, catering to the needs of startups and large enterprises alike. The platform has since evolved, supporting businesses in over 120 countries, showcasing its global impact and innovation-driven ethos.

Regulatory Compliance and Licensing

Stripe prides itself on its robust security measures and adherence to banking regulations. It is a licensed money transmitter in the US, adhering to the stringent requirements set by the Financial Crimes Enforcement Network (FinCEN) and various state regulatory bodies. This compliance underscores its reliability and official standing in the financial ecosystem.

Where Stripe Finds Its Use

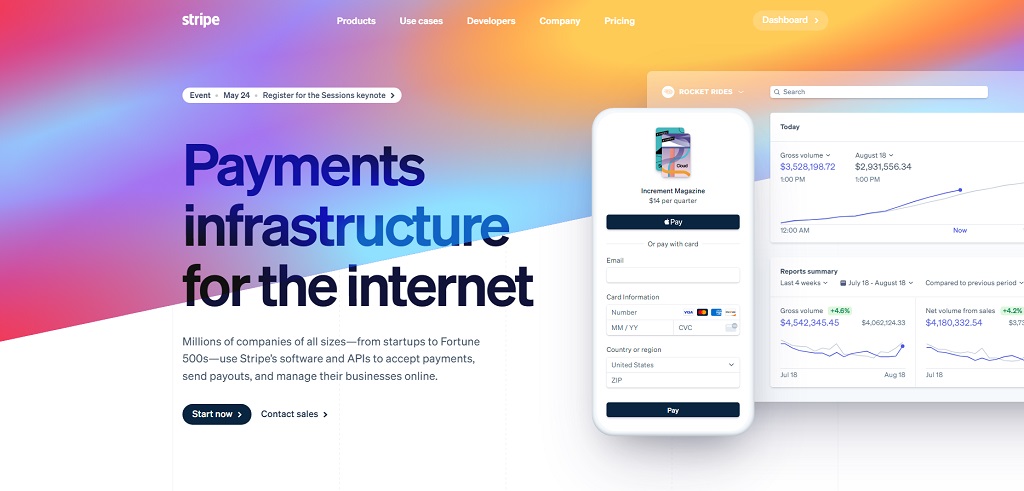

Stripe’s versatility extends across online marketplaces, subscription services, e-commerce stores, and mobile applications. Its global reach and multi-currency support enable businesses to accept payments from customers anywhere in the world, making it a preferred choice for companies looking to scale internationally.

Stripe and Online Casinos

The integration of Stripe with online casinos represents a significant advancement in the gaming industry. Its security features and fraud detection capabilities offer a safe transaction environment for players, although its use in this sector depends on the legal and regulatory framework governing online gambling in each jurisdiction.

Advantages Over Competitors

Stripe stands out for its developer-centric approach, comprehensive payment infrastructure, and unparalleled ease of use. Its continuous innovation in payment technology and customer experience sets it apart from competitors, offering businesses a scalable and efficient payment processing solution.

Stripe’s Enduring Legacy

As Stripe continues to shape the future of digital payments, its legacy is marked by the democratization of online transactions, making it easier for companies of all sizes to participate in the global economy. Its ongoing commitment to innovation and security remains a beacon for the fintech industry.